What I'm frustrated by in crypto

crypto applications frustrationsFor the past little while, I’ve been wrestling with certain frustrations in the crypto space and doubts about what the future for crypto looks like that I haven’t been able to reconcile. This post is an attempt at articulating them.

Disclaimers

First, a couple of disclaimers.

This is a bit more of an opinionated piece, as always, these are my views and my views alone. I debated whether or not to publish this, but I decided to do so because I think discussion around topics like these helps advance the broader ecosystem and that’s immensely valuable.

I wrote this piece not from a pessimistic point of view, but from an intellectually honest perspective of where we are now and how far the space still has to go view. I’m still optimistic, but I’m cautiously optimistic. I hope my tone does not come across as unfairly cynical or pessimistic when I was just trying to be honest with myself but there is always a chance it will get interpreted that way. I know that it’s still early, and I know that building is hard and takes time. I’m not trying to criticize for the sake of criticizing, and I’m not trying to discount people’s hard work or energy in the space in any way whatsoever. I understand what crypto stands for, I understand the philosophy and the why, which is what got me into the space in the first place: credible neutrality, ownership, interoperability, verifiability, permissionless, coordination, immutability, incentives, censorship-resistance etc. But, I don’t think that we should hold ourselves to lower standards because of these values.

This post and my frustrations do NOT apply to every part of the crypto space, I’m NOT saying this applies to every product, every protocol etc. I’m just saying these are general patterns I’ve noticed across the board

Introduction

When I go to crypto conferences, I like asking people I meet “in the present state of crypto or blockchains, what applications do you think are solving real-world problems? Problems that if you abstracted the crypto part away (because people are not going to use a crypto product just because it’s “decentralized”, they want convenience and won’t settle for something that doesn’t solve a problem), people would still use it because it solves a problem for them”? Note I classify games and entertainment as also solving a problem of it being fun.

This sounds like a stupid question given the amount of money and number of products in the space, but seriously, try answering it.

I’ve rarely gotten good answers. Often, I’ll get “probably nothing” or “I don’t know” or something to that effect, and many of these answers have been from crypto veterans, people who have been in the crypto space for 6+ years.

I like to ask this question because personally, I’ve found very few applications in crypto that from a product perspective, actually have product-market fit. In other words, they solve problems (that they aren’t just creating themselves) for people and have users that are not just using it to elaborately speculate and gamble.

And yes I know that it’s still early, yes these things still take time, yes the infrastructure is not fully ready yet, but why are we prepared to treat applications in crypto differently to the way startups have worked for literally millenia? Why are we prepared to write off the lack of users in crypto, the lack of real-world demand for reasons other than the fact that for most people crypto genuinely does not yet solve real-world problems for them?

Crypto and startups

By now, we know a lot about how to build startups. We know how to build product, we know how startups work, we know we have to talk to users, we know that users use our products because they solve problems for them (or they have fun using it), and it feels like so much of the crypto space has just completely thrown all of this out of the window. What happened to talking to users? What happened to solving problems for your users? What happened to being honest with standard KPIs in startups like churn and real-world demand as a reflection for whether we’ve built something people actually want? And the reason it’s tricky is because the financial/money aspect is now explicit in the way we design applications in crypto. This is both its beauty and its poison. So when there is money to be made, people who want to make money will inevitably try to use it as a playground for doing so.

Which means there will always be some level of speculation and gambling in crypto. It’s inevitable and it’s not necessarily bad. The point isn’t that speculation is bad, the point is that in order for applications on crypto to become truly mainstream, it has to do more than just that. It has to solve a problem for people. If crypto never graduates this playground of speculation, if crypto was just a period of time where a bunch of people made/lost a lot of money, and a bunch of smart people worked/nerd-sniped each other on interesting problems, I will personally have considered it a giant failure.

The main thing I’ve been trying to reconcile is the difference between the narratives of what crypto can enable in theory and what that ends up looking like in practice today, and the answer to the latter is genuinely mostly speculation and gambling or just solutions to problems the product is creating.

And maybe you think it’s unfair to make the claim that almost all of crypto is speculation and gambling, but just dissect general patterns in any domain in crypto and look at practical applications that have real-world demand from users. It’s very possible and likely that I will miss applications, but again I’m looking at general trends across different parts of crypto.

Brief survey of domains in crypto

DeFi

To start with DeFi, maybe the domain crypto is most poised to offer concrete solutions for, I asked myself how much of DeFi is really “helping bank the unbanked” or offering practical financial solutions for people. There are personally maybe four products (I don’t count perps) in DeFi today that I think are solving concrete problems in the space with consistent usage across macro conditions: Uniswap (or DEX equivalents like SushiSwap or Curve), Aave, Compound, and makerDAO. Side note, even AMMs, despite being a new primitive from DeFi are worse from a product experience than regular order books - they introduce impermanent loss for liquidity providers, slippage for traders, negative externalities via MEV (sandwiching, frontrunning, backrunning etc.) and large trades will just get rekt without Flashbots or something to break up that trade over splits (which AMMs do not handle by default). But even then, let’s just ignore this for now.

How much of the liquidity in these services is not people using it to speculate and gamble?

Sure maybe for some, it’s people making their capital more productive (e.g. being an LP), but they can make their capital more productive only because there’s a market for these services, and there’s a market for it (i.e. users) because it allows users of these services to then use that capital to speculate. Look at usage patterns of these services in crypto. DEXs, permissionless lending and borrowing, stablecoins, they’re mostly just leverage for users who actually use them. I’m not saying all usage is leverage, but most usage is, most usage is not people in low-income countries who don’t have access to financial infrastructure they can depend on. In fact, many practical financial services (like mortgages or ISAs) that people would need in society do not exist and may never be able to because it’s unlikely undercollateralized lending could ever sustainably work in a highly adversarial on-chain environment without some real-world arbitration.

And to be fair, you can make similar arguments for certain parts of TradFi, like high-frequency trading etc., but the difference is that a lot of the speculative services in TradFi are backed by practical applications for retail users, under collateralized loans, mortgages, reputation-based credit markets, fraud protection via law enforcement, bankruptcy protection etc.

So I don’t know, maybe the end game of DeFi is not to be completely permissionless for retail users, maybe it’s some protection that TradFi offers, maybe it gives users who want to speculate the risk/reward of doing so and for others it’s just a more convenient, digital form of some select services, I don’t know.

I’m not suggesting DeFi is a dead end or that DeFi will end up looking closer to TradFi than most people realize (although I do think there’s a lot of truth in this), I’m just saying that almost all of DeFi usage today is currently speculation and gambling, and that average retail users will probably not care about this.

NFTs

I think practical use cases of NFTs that have garnered a lot of usage have ended up with NFTs working similar to collectibles in the real world. Which means most NFT volume is people trading them trying to make money (i.e. via speculation and gambling), although some people who own NFTs are people who hold them because they do believe in the community or (it becomes just like a regular collectible and people can use them) to indicate status, alignment, views etc.

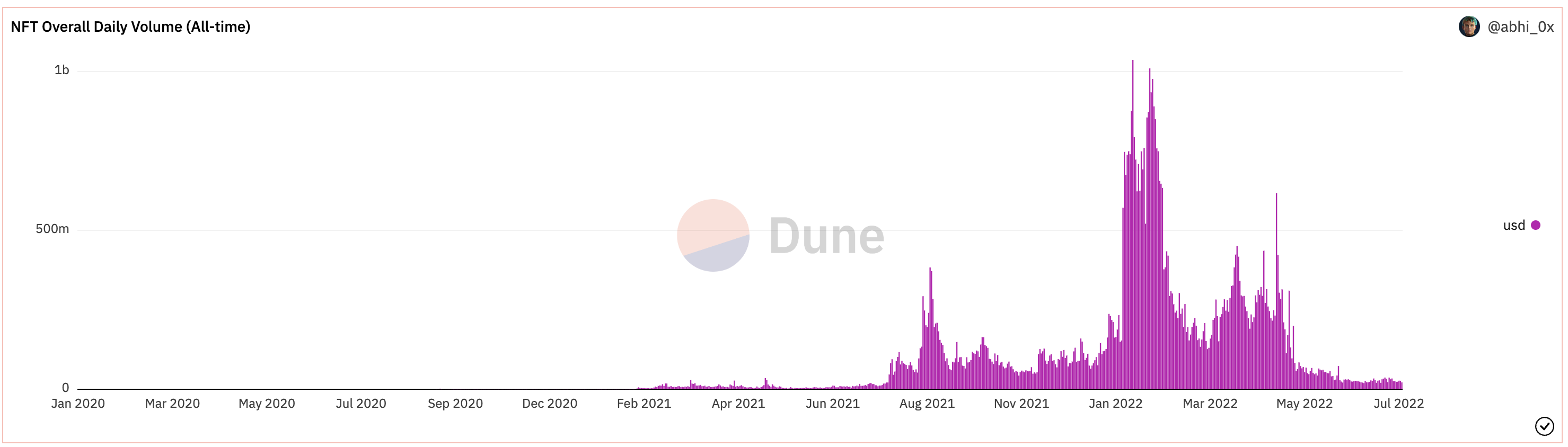

If you look at NFT overall daily volume (original Dune query here), you can see volume now has decreased back to pre-Aug 2021 days - how much of that spike in volume and demand can be attributed to hype and speculation, where people tried to take advantage of the time to make money? It’s hard to determine empirically and NFT trades are not the only measure for whether people still use NFTs, but it’s an important datapoint to keep in mind about whether users are coming back to NFTs or not (the same way a startup after it gets press will have a spike in users that drops back to normal/a little higher than normal).

And there are some things like utility NFTs, or POAPs, or soulbound tokens, or gaming NFTs which could lead to interesting experiments but again they just haven’t seen that much usage practically that I’ve found compared to their usage as a collectible.

My tl;dr view on NFTs are that they are an interesting and useful primitive (pointer to something on chain) but they will probably for the most part continue to remain and act (i.e. get bought, sold, traded) as collectibles, unless other applications in crypto become popular (i.e. games) that can take advantage of this primitive

Gaming

I don’t want all the use cases to just be pessimistic and gaming is one of the ones I’m most optimistic about. That said, if you look closely, a lot of gaming volume so far has been “play to earn” and that was again just an extension of speculation and gambling (e.g. with Axie and others).

I think one of the exceptions to this rule is Dark Forest because the team intentionally avoided having some kind of tokenomics that people could use to speculate or earn money. So Dark Forest was “pay to play” i.e. people literally lost money in order to play the game because it was fun, so a big signal that the product was actually useful (i.e. fun) to people.

Zero-knowledge

I’m a big ZK simp, but again if we’re trying to be practical, I’d classify use cases of ZK into two buckets: scalability and privacy/pseudonymity.

Scalability in the way ZK rollups are used for example, so proving a sequence of state transitions without having to run every one. For all practical purposes, this use case mainly becomes useful if there’s demand for blockchains. Another cousin use case of scalability is verifiability, so getting practical guarantees that execution was ran the way it was intended to (which is not blockchain specific, this has use cases in software more broadly).

And pseudonymity in that you get cryptographic guarantees without having to reveal everything about your data e.g. lots of applications in identity (e.g. heyanon) - although this is not necessarily related to blockchains - verifiable computation, homomorphic encryption (so many consequences for ML, e.g. training on transformed data to preserve privacy of original data) private marketplaces/transactions (e.g. Aztech), and probably a whole suite of new applications that weren’t possible before.

I’m personally quite excited by ZK, but again there are very few practical ZK applications that are widely used today, that solve real problems - their use in scalability I would classify under infrastructure, which as I will elaborate on below, is hinged on actual demand for applications on blockchains being built that are used for purposes other than mostly speculation.

And part of it is that ZK is still new, the tooling is not super mature, so these applications are probably still a couple of years out, but as of today, there just isn’t a lot of real-world usage.

DAOs

DAOs have been largely used as the de-facto organizational structure for lots of communities / projects / products in crypto so they do have some usage, but they’re not without their problems - governance ends up being mostly centralized in some token holders, we still haven’t seen that many non-financial implementations of governance (although Optimism is trying some interesting experiments in this domain), and DAOs have little to no recognized legal liability (which is why people working for DAOs often have to contract their work under LLCs to have some liability protection and many DAOs are based outside of the US).

I suspect that DAO structures will slowly converge towards LLC-like structures (because these have been around long enough to be battle tested against all of the problems that arise because coordination is hard), but this is just a hunch.

So in terms of what DAOs are solving, I think they’re just an organizational structure for things (communities, companies, groups of people) in crypto, so they are solving a problem, but will the average retail user care about DAOs if they are not actively involved in things (for work or fun) in crypto? My question is why should they?

Infrastructure

I think infrastructure is important and there are lots of interesting experiments in consensus, settlement, data availability, state management, programming paradigms that projects are taking (although not enough innovation in other parts that I agree with Polynya on). I think a lot of value accrual will occur on the infrastructure layer, but if there’s not enough demand for applications built on top of infrastructure, then unfortunately as cool as infra is, it will never have been more than just a couple of interesting distributed systems experiments.

In other words, it doesn’t matter how much time, resources, energy we put into infrastructure development (making blockchains more secure, decentralized, scalable etc.) if in the end, there turns out to be not a lot of demand for applications built on top of them.

This is not meant by any means as a complete survey of every aspect of the crypto space, I’m definitely missing certain domains (like consumer, social etc. but I personally think those currently even have less PMF than the others), but purely just looking at general trends in major parts of the ecosystem. And the conclusion I reached was that most on-chain activity today was largely speculation. And for products that did not fall into this, either they were solving problems they created or still had challenges we hadn’t yet figured out.

Thoughts

I think a lot of crypto space, maybe because of its roots in cypherpunk culture, tries to reinvent the wheel on things that regular financial, governmental structures have A/B tested for a very long time and produced battle-tested solutions for. And some of these innovations do make sense in a new environment. But many of the changes are trying to do things that we’ve already figured out don’t work in the real-world (e.g. purely algorithmic stablecoins or undercollateralized stablecoins broadly).

A lot of this may come off as pessimistic but I’m not trying to be pessimistic for the sake of being pessimistic. I’m trying to be intellectually honest with what the current state of applications in crypto today is. And I’m not saying there aren’t any or that there won’t be new ones in the future, but if we’re being honest and practical about what real problems most applications solve that have gained sufficient usage, there aren’t many. And maybe part of it is that it’s still early, maybe part of it we still haven’t figured out how to abstract away the crypto components in a way that the average retail user can use, maybe crypto will never graduate the current state of what it is today because a lot of services are already accessible to people in a way that crypto does not provide enough of an improvement on. I don’t know.

But I think the crux of it basically comes down to this: I’ve noticed a large disconnect between the narrative for what crypto enables and what that practically looks like today/may look like in the future. And at some point, we can’t keep writing this off to the space still being early. It’s been nearly 14 years since the Bitcoin paper galvanized the crypto space, although smart contract chains to be fair have been around for 7 years.

Don’t get me wrong, I can see practical use cases for crypto, the main one being trustless, censorship-resistant money, an easy way to transact (i.e. wire transfers) and store money (i.e. using Ethereum as a simple bank account). So it’s natural to see things naturally emerge from this (a bright financial ecosystem that builds on top of this, new coordination mechanisms, games that take advantage of blockchains as a new computing paradigm etc.) but I do feel like a lot of products in crypto do not solve enough of a (high frequency or severity) problem for the average person.

All that said, I’m cautiously optimistic for the future. There are and I hope there will continue to be novel applications enabled by all of the cool properties of blockchains that we care about. But I want to be honest about where the current state of crypto is and just how far out we really are.

So many people ask “how do we onboard the next billion people to blockchains” and I find it confusing because that question feels like it has an obvious answer. We will onboard the next billion people to blockchains when there are applications built on top of them that actually solve problems for people.

I worry sometimes that the value prop of blockchains is so enticing and convincing in theory that we use that as an excuse to lower our standards in practice. I don’t want to settle for a world where crypto is just speculation and gambling. I don’t want to use its narrative as an excuse to avoid admitting that a lot of crypto is in fact people rugging, scamming, and gambling. I don’t want to use the fact that it’s early as an excuse to why my non-crypto friends don’t use the products folks in the space use regularly.

I want a future where the applications on blockchains are so useful, convenient, and fun that people use them because they’re an order of magnitude better than their alternatives and enable the fundamentally new things they’re capable of. Not a world where we convince more people to use crypto because of a fancy narrative for what blockchains can enable in theory.

If you’ve made it this far, I would love to hear your thoughts, please reach out on Twitter!

Thanks to Lakshman, verumlotus, cha0sg0d_, straightupjac, and eva for all of the thoughtful feedback on early drafts of this post.